Maksu VPOS 3.0 - REVISION 1.5 FROM 11.04.2025

1. Overview

2. MAKSU VPOS interface for merchant shop

3. XML/JSON API Interface

4. XML/JSON API Interface

Maksu VPOS 3.0 Merchant integration

Redirection version 5, XML/JSON API5 | Revision 1.5 | 11.04.2025

DISCLAIMER

Maksu disclaims all warranties and conditions with regard to the Products described in this document or other Maksu products, including all warranties and conditions of merchantability, whether express, implied or statutory, fitness for a particular purpose, title and non-infringement.

Maksu Development does not warrant that the Product shall satisfy customers’ specific requirements, or that copies of the Product other than those provided or authorized by the Maksu shall possess functional integrity. Also, Maksu makes no warranties with respect to the fitness and operability of modifications not made by Maksu

Maksu makes no warranties as to the accuracy of the information in this document. The information is based on the knowledge and information available in the time of issue and is subject to change without any notice.

LIABILITY

In no event shall Maksu be liable for any loss or damage to revenues, profits or other incidental, indirect and consequential damage of any kind, resulting from use of Product or Product’s performance.

CONTACT

Any enquiries relating to this document should be directed to:

Maksu GMBH

Millennium Tower, 23rd and 24th Floor,Handelskai 94-96

AT-1200 Vienna

AUSTRIA

E-mail: support@Maksupay.com

1.0. Overview

Maksu VPOS is a payment application that is designed for processing merchant payments in e-commerce environment. The inputs to VPOS are requests from merchant shopping solution and from there the payment process is controlled by VPOS until the payment has completed successfully or failed and the information will be sent back to merchant shopping solution.

The payment methods available will depend on area application will be used and which are necessary for the client business model. It could have enabled credit and debit card payments that are also integrated with

Integration with 3D Secure server technology or external payment methods like net payments in shopper local banks and so on. Exact payment methods available should be specified by client and setup.

Maksu VPOS core design enables multiple types of merchant interfaces to be implemented and also the easy to implement secure default interface.

Merchants can easily attach their look and feel to payment pages by supplying their own custom CSS stylesheet.

This document describes newest version 5.0 of interfaces to date based on RSA SHA256 signature security (5.0).

Payment services provide by Maksu include but not limited to following option:

- MasterCard, VISA, American Express (ask availability), GooglePay™, ApplePay™,

- 3D-Secure and many local payment methods by banks and wallets in Europe and elsewhere.

1.1. Security notes

VPOS merchant interface delivers great level of security. Messages are signed and verified with 3072 bit RSA Keys. Client side encryption also uses 3072 bit RSA public key to encrypt cardholder and PAN in user browser..

1.2. Changes recorded:

1.0 26.09.2024 Intitial version of V5 interface documentation

1.1 30.09.2024 – Added 3DS API desciptions

1.2 23.12.2024 – Some content fixes

1.3 28.01.2025 – orderDesc, var1..9 lengths to 4000 supporting items.

1.4 25.03.2025 – Using GooglePay™ with Maksu API, small API naming adjustments.

1.5 11.04.2025 – Document structure changes, Sandbox and production endpoints.

2.0. Intro

Communication between Maksu VPOS and Merchant shopping cart software can be implemented via HTTP post protocol following the specification below.

2.1. Merchant shop requests to initiate payment with Maksu VPOS

Endpoints:

Production: https://pay.eu.maksupay.com/vpos/shophandler

Sandbox: https://pay.test.maksupay.com/vpos/shophandler

The following table describes the parameters of the POST from the payment page to VPOS.

| Field (HTTP POST parameter) | Required / Optional | Description |

|---|---|---|

| version | R | Required for interface version 5 |

| mid | R | Merchant id supplied (integer number) will be supplied to merchant, max length 30 |

| lang | O | lang O Language selection for payment page (ISO 639-1 language code en, fi, sv…) |

| trType | R | Transaction type, valid values 1 – payment, 2 – pre authorization (applicable only to card payments only), 8 – tokenization only – perform tokenization no payment. Shall be with orderAmount = 0.0 |

| orderid | R | Merchant shop order id provided by merchant shop max length 50 chars (string 1..50) |

| orderDesc | R | Order description text (string 1..128) |

| orderAmount | R | Order amount (decimal number >0.0 or 0.0 for tokenizer) max length 13 with decimal point (up to 12 numbers) |

| currency | R | Order amount currency (string 3 ISO ISO 4217 alphabetic code (EUR, USD)) |

| payerName | O | Order payer name, highly recommended, required for some payment flows |

| payerEmail | O | Order payer email address (string 1..64), Optional but strongly recommended. |

| payerPhone | O | Order payer phone number, optional but strongly recommended (string..30) |

| billCountry | O3DS2 | Billing address country code (string 2 ISO 3166-1-alpha-2 code (US, FI, GB)) |

| billState | O3DS2 | Billing address state (string..50) recommended Var str 3 3166-2 country subdivision code |

| billZip | O3DS2 | Billing address zip code (string..16) |

| billCity | O3DS2 | Billing address city (string..64) |

| billAddress | O3DS2 | Billing address street (string..100) |

| shipCountry | O/R | Shipping address country code (string 2 ISO 3166-1-alpha-2 code (US, FI, GB)) Optional, required when parameter weight or dimensions are present. |

| shipState | O/R | Shipping address state (string..50) Optional, required when parameter weight or dimensions are present. Recommended Var str 3 3166-2 country subdivision code |

| shipZip | O/R | Shipping address zip code (string..16) Optional, required when parameter weight or dimensions are present. Optional, required when parameter weight or dimensions are present. |

| shipCity | O/R | Shipping address city (string..64) Optional, required when parameter weight or dimensions are present |

| shipAddress | O/R | Shipping address street (string..100) Optional, required when parameter weight or dimensions are present. |

| weight | O | Order shipping weight (kg) if item is shippable and shipping needs to be calculated by VPOS (decimal number >0) max length 12 with decimal point For electronic deliveries send weight=0.0 |

| dimensions | O | Order shipping dimensions (mm) in format width:height:depth for example a box 200:200:200 (string..25) can be used for shipping calculation if implemented so |

| addFraudScore | O | Incoming starting risk score (integer) max length 12 |

| maxPayRetries | O | Maximum payment retries allowed before user is sent back to merchant, overrides specific profile setting if present (integer) max length 2 |

| reject3dsU | O | Should 3-D Secure return U status, merchant has option of continuing the transaction without liability shift or reject the transaction. >If this value is true, the transaction will not be accepted. (string 1 Y/N) |

| payMethod | O | For pre selection of payment method. Paymethod id , can be used to preselect payment method at merchant site, so user can not select other payment method later (string..20), exact values will depend of implemented methods on service provider side. |

| blockScore | O | Optional bloack score parameter that will be used to block the transaction if transaction riskScore reaches this value or above. (Postive Integer number) max length 9 |

| cssUrl | O | The absolute or relative (to vpos location on server) url of custom CSS stylesheet, to be used to display payment page styles. (string..128) Note: if absolute and payment page is SSL secured make sure the URL is also SSL secured as browsers will not show unsecured element object warnings. This may be subject of approval |

| confirmUrl | R | Confirmation URL where to send payment confirmation in case payment was successful (string..128) |

| cancelUrl | R | Cancel url where to send payment feedback in case payment has failed or was canceled by user (string..128) |

| extInstallmentoffset | O | Optional. In case installments are supported by the processing system then this parameter of installments can be used to indicate initial offset in months when first payment will be submitted (by acquirer). Applicable for card payments only. Integer max length 3 |

| extInstallmentperiod | O/R | Optional, required in case previous parameter is present. In case installments are supported by the processing system then this parameter of installments is to used to indicate number of payments/months the merchant requests for installments. Applicable for card payments only. Value must be >1. Max length 3 Installment parameters and recurring parameters together are not allowed on same request |

| extRecurringfrequency | O | Optional. In case recurring payments are supported by the processing system then this parameter can be used to indicate frequency of recurring payments, defines minimum number of days between any two subsequent payments .The number of days equal to 28 is special value indicating that transactions are to be initiated on monthly basis. Applicable for card payments only. Max length 3 |

| extRecurringenddate | O/R | Optional, required in case previous parameter is present. In case recurring payments are supported by the processing system then this parameter can be used to indicate date after which recurring ends and no more transactions no more transactions are initiated. The format is YYYYMMDD. Applicable for card payments only. Installment parameters and recurring parameters together are not allowed on same request. |

| extXOrderId | O | Optional merchant and acquirer agreed extension for recognizing returning customers with submitting previous successful order id of the merchant recognized customer. If functionality is not enabled for merchant this parameter is silently ignored. |

| extTokenOptions | O | Optional merchant and acquirer agreed extension for generating a card token on successful payment. If functionality is not enabled for merchant this parameter is silently ignored. (number string ..3) To request new token value (on new card) first char shall be set to 1 To request auto payment (wo need user enter cvv) with existing token second char shall be 1. To request full auto payment (wo need to do 3d) with existing token third char shall be 1 (in order full auto to work both cvv omit and 3d omit shall be set 1 and allowed in merchant settings). |

| extToken | O | Optional merchant and acquirer agreed extension for recognizing tokens of returning customers with submitting previously generated card token. If functionality is not enabled for merchant this parameter is silently ignored. |

| var1 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| var2 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| var3 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| var4 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| var5 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| var6 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| var7 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| var8 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| var9 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| signature | R | Version 5: Message signature to ensure and verify message security and integrity. RSA with SHA2 256 signature of all the field values above concatenated together (see section 2.4). |

| publicKeyHash | O | Optional but highly recommended. The SHA-2 256 base64 hash of X509 encoded public key to verify signature, useful if merchant has multiple public keys in file or in transition from one key to another, so correct public key can be selected for validation |

3DS2– required with some schemes when 3DS2, so strongly recommended to send always.

If extension parameters extInstallmentoffset, extInstallmentperiod are present and valid then the request in considered an installment payment (parent).

If extension parameters extRecurringfrequency, extRecurringenddate are present and valid then the request in considered an recurring payment (parent).

All parameters in the post must be in form default encoding (application/x-www-form-urlencoded) and form must be submitted with utf-8 encoding.

form.action="{supplied vpos service url}"

form.method="POST"

form.enctype="application/x-www-form-urlencoded"

form.accept-charset="UTF-8"

2.2. VPOS return message POST to inform merchant shop about payment success or failure.

The following table describes the parameters of the POST from VPOS back to merchant shop.

| Field (HTTP POST parameter) |

Required/ Optional | Description |

|---|---|---|

| version | R | Version 5 |

| mid | R | Merchant id supplied (integer number) max length 30 |

| orderid | R | Merchant shop order id string max length 50 |

| status | R | Payment status (string..16) see section 2.5 payment statuses |

| orderAmount | R | Order amount (decimal number >0.0) same as in request |

| currency | R | Order amount currency (string 3, ISO ISO 4217 alphabetic code (EUR, USD)) same as in request |

| paymentTotal | R | Order amount plus fees and shipping and additional service charges if applicable (decimal number >0,0) Required when payment was a success, can be omitted when payment fails or canceled |

| message | O | Optional message (string..128) can provide optional information about payment or error description. |

| riskScore | O | Optional information about the possible risk with transaction (integer number) |

| payMethod | O | Optional information about payment method used to complete transaction (string 20). Is present only when payment was success |

| txId | O | Optional system assigned transaction reference id (integer number) |

| paymentRef | O | Optional end payment system reference or approval code. String 1..64 |

| shipCountry | O | Shipping address country code (string 2 ISO 3166-1-alpha-2 code (US, FI, GB)) Optional, may be present if returned from wallet |

| shipState | O | Shipping address state (string..50) Optional, may be present if returned from wallet |

| shipZip | O | Shipping address zip code (string..16) Optional, may be present if returned from wallet |

| shipCity | O | Shipping address city (string..64) Optional, may be present if returned from wallet |

| shipAddress | O | Shipping address street (string..100) Optional, may be present if returned from wallet |

| shipRecipientName | O | Shipping recipient name (string..100) Optional, may be present if returned from wallet |

| shipRecipientPhone | O | Shipping recipient phone number (string..35) Optional, may be present if returned from wallet |

| extToken | O | If merchant requested tokenization and tokenization enabled then on successful payment token value of card used will be returned. |

| extTokenPanEnd | O | If merchant requested tokenization and tokenization enabled then on successful payment last 4 digits of tokenized pan are returned. |

| extTokenExp | O | If merchant requested tokenization and tokenization enabled then on successful token payment token expiration is returned in format YYYYMMDD |

| extData | O | Optional merchant and acquirer agreed variable type string ..1024 May be encoded and contain subfields in format p1=v1&p2=v2.. (+url encoded value) |

| var1 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| var2 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| var3 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| var4 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| var5 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| var6 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| var7 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| var8 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| var9 | O | Optional merchant and acquirer agreed free variable type string ..1024 |

| signature | R | Version 5: Message signature to ensure and verify message security and integrity. RSA with SHA2 256 all the field values above concatenated together having ; in end of each values . Signed by processor private key. Merchant shall obtain Certificate of processor from service provider. (see section 2.4) |

| publicKeyHash | R | The SHA-2 256 base64 hash of X509 encoded public key to verify signature, useful if processor has multiple public keys set up or in transition from one key to another, so correct public key can be selected for signature validation |

Note: When payment is success the message is returned to url provide by merchant confirmUrl parameter in request. If payment fails or is canceled the message is returned to cancelUrl parameter provided in merchant request.

Note2: There is also available configurable option that server sends in background delayed (5..120 seconds) independent confirmation message (copy of redirection confirmation) to merchant server without user browser interaction as sometimes user browser may fail to reach back to merchant site. So it is recommended that merchant systems are prepared to handle multiple confirmations for same order properly due this feature and also possible user browser reloads, back buttoning etc. Background confirmation http request can be identified by having user-agent header set to value “Maksu VPOS”

2.3. Recurring notification POST

The following table describes the parameters of the direct POST from VPOS back to merchant shop (recurring notifications url) in case of scheduled recurring child is processed by VPOS server.

| Field (HTTP POST parameter) |

Required/ Optional | Description |

|---|---|---|

| version | R | Version 5 value 5 |

| mid | R | Merchant id supplied by PSP (integer number) |

| orderid | R | Original Merchant shop order id (unique) |

| status | R | Payment status or the recurring child (string..16) see section 2.5 payment statuses |

| orderAmount | R | Original Order amount (decimal number >0.0) same as in parent recurring request |

| currency | R | Original Order amount currency (string 3, ISO ISO 4217 alphabetic code (EUR, USD)) same as in parent request |

| paymentTotal | R | Original Order amount plus fees and shipping and additional service charges if applicable (decimal number >0,0) Required when payment was a success, can be omitted when payment was failed or canceled |

| message | O | Optional message (string..128) can provide optional information about payment or error description. |

| riskScore | O | Optional information about the possible risk with transaction (integer number) |

| payMethod | R | Information about payment method used to complete transaction (string 20). Is present only when payment was success |

| txId | R | Original recurring parent system assigned transaction reference id (integer number) |

| sequence | R | Sequence number or recurring (parent has sequence number 1, the first recurring child will have sequence number 2, etc) |

| seqTxId | R | The sequence transaction unique id in system (Integer) |

| paymentRef | O | Optional end payment system reference or approval code. String 1..64 |

| signature | R | Version 5: Message signature to ensure and verify message security and integrity. RSA with SHA2 256 all the field values above concatenated together having ; in end of each values . Signed by processor private key. Merchant shall obtain Certificate of processor from service provider. (see section 2.4) |

| publicKeyHash | R | The SHA-2 256 base64 hash of X509 encoded public key to verify signature, useful if processor has multiple public keys set up or in transition from one key to another, so correct public key can be selected for signature validation |

2.4. Calculation of the Signature

The signature in the incoming POST and in the return POST is calculated by the following rule.

1. Concatenate all the values of all the possible non empty fields listed in the table, the same order as parameters are listed in table and having ; at the end of each added field. If a parameter is omitted or empty nothing is concatenated.

Version 5:

2. Calculate RSA with SHA2-256 signature of step 1 (using of UTF-8 char encoding when converting

string to bytes) using Your private key.

3. Return the signature

4. Encode signature bytes with Base64 encoding signature=base64(RSA with SHA2-256( utf8bytes(value1;value2;…;value n;) ) )

Note: ‘;’ is separator between values concatenated and at the end of last value.

If optional value is missing or empty do not add any value and no separator as well.

Never implement the signature calculation in browser using javascipt or similar as this way you expose your private key to the world. Only implement it ins server side executed code as (jsp/servlet/asp/php etc).

2.5. Payment statuses in response message

AUTHORIZED, CAPTURED – payment was successful (accept order)

CANCELED – payment failed, user canceled the process (deny order)

REFUSED – payment failed, payment was denied for card or by bank (deny order)

REFUSEDRISK – payment failed, payment was denied for card by risk score (deny order)

ERROR – non recoverable system or other error occurred during payment process (deny order)

COMPLETED – tokenization only completed successfully

2.6.1 With openssl

Its just possible to do all in one line:

openssl req -x509 -newkey rsa:3072 -sha256 -keyout merchantkey.pem -out merchantcert.pem -days 365 -subj "/C=EE/ST=My State/L=my City/O=Company Name/OU=7711223/CN=www.mysite.com"The output file merchantcert.pem need to be sent to service provider to install with Your merchant account so Your messages will be validated with public key in Your certificate.

C – is two letter country code

L – locality eg. city where you are located.

OU – is recommended to fill with Your merchant number with service provider.

O – shall be your company full or public name.

CN – is recommended (not required as with server certificates) to be your website name

rsa:keysize is recommended to be 2048 or 3072 bits for foreseeable future and validity days up to 1460 days (4 years), ask service provider if it has specific policy or requirements.

Use necessary measures to protect your private key in generated file merchantkey.pem.

Converting private key to PKCS8 format handleable by java:

openssl pkcs8 -topk8 -in merchantkey.pem -inform PEM -outform PEM -out merchantkey-p8.pem -nocrypt2.6.2 With java keytool

With java keytool private key remains in keystore and cannot be extracted unless special software is used. So Your software shall operate directly with this keystore then.

keytool -genkey -keyalg RSA -sigalg SHA256withRSA -dname "CN=www.mysite.com,OU=7711223,O=Company Name,L=My City,S=My State,C=EE" -keysize 3072 -validity 1460 -alias mykey2025 -storetype PKCS12 -keystore mykeystore.p12 -keypass strongPassKey -keystore mycerts.p12 -storepass strongPassNow export Your certificate to a file that can be sent to service provider:

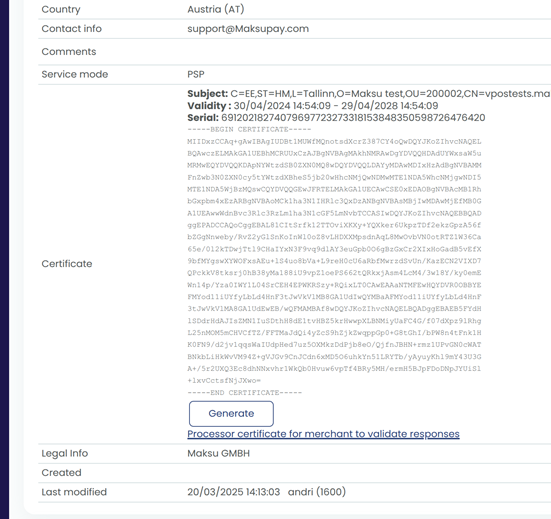

keytool -exportcert -alias mykey2025 -file merchantcert.pem.cer -storetype PKCS12 -keystore mycerts.p12 -storepass strongPass -rfc2.6.3 Maksu backoffice

Maksu backoffice for merchants also has tool to generate merchant signing keys with few clicks.

In merchant main page click “Generate” button to generate new signing private key and public key to be stored in Your Maksu account to verify Your signed messages.

Special data cases

2.7.1. Order items

Some payment methods may require order item and tax details. To send such info use var1..va9 fields in format, then use prefix “items:” and values is JSON array of item objects, for example as follows

items:[{“t” :”p”, “n” :”Dennis ball”, “c” : “1234001”, “q” : 2 , “qu” : “pcs”,“up” : 100, “tp” : 200, “tt” : 36, “tr” : 2200},

{“t” :”st”, “n” :”VAT 22%”, “c” : “vat22”, “q” : 1 , “qu” : “%”,“up” : 2200, “tp” : 36, “tt” : 36, “tr” : 2200]Fields:

t – means type :

p – physical, d-discount, sf -shipping fee, st – sales tax, d – digital , g – giftcard, sc – store credit,

s – surcharge, su – subscription

n – means product name

c – means product code

q – means quantity

qu – means quantity unit eg pcs or m etc

up – unit price eg 100 (in cents, includes tax)

tp – total price eg 200 (in cents includes tax)

td – optional total discount amount (in cents)

tt – total tax (eg vat included)

tr – tax rate eg tax prsentage 2200 means 22%

if type=sc

spi – subscription interval (“DAY” “WEEK” “MONTH” “YEAR”)

sbic – subscription interval count

Recurring control:

rcauto:false

if merchant wants self submit executions of recurring payments instead of auto scheduling can submit this flag in

var1..var9

Mail telephone order:

moto:true

If merchant wants to initiate mail telephone order instead of ecommerce then can submit this flag in var1..var9

3. XML/JSON API Interface

The XML/JSON API interface plugin makes possible that merchants with their own payment pages hosted in their system to use e-commerce services provided by VPOS using XML or JSON messaging.

XML/JSON Messaging is using request real time and response messages in the same request/response cycle. In request message merchant provides payment and order info and in response messages VPOS indicates the result of the action performed. By default the merchant should receive the response message within 30 seconds maximum.

Root element of request and response messages is VPOS

Current version of XML/JSON API is 5.0

The request message general structure:

<VPOS xmlns="http://www.modirum.com/schemas/vposxmlapi5" xmlns:ns2="http://www.w3.org/2000/09/xmldsig#">

<Message id="M1727355916647" senderId="200002" ts="2024-09-26T13:05:16.647Z" version="5.0">

<SaleReq merchantId="200002">

<OrderInfo orderId="O1727355899011">

<OrderDesc />

<OrderAmount>1.25</OrderAmount>

<Currency>EUR</Currency>

</OrderInfo>

<PaymentInfo>

<PayMethod>visa</PayMethod>

<Card>

<Pan>4016360000000010</Pan>

<ExpDate>2712</ExpDate>

<CVV2>756</CVV2>

<HolderName>John Smith</HolderName>

</Card>

<PayerEmail />

<PayerIpAddress>172.29.0.1</PayerIpAddress>

</PaymentInfo>

</SaleReq>

</Message>

<ds:Signature xmlns:ds="http://www.w3.org/2000/09/xmldsig#">

<ds:SignedInfo>

<ds:CanonicalizationMethod Algorithm="http://www.w3.org/TR/2001/REC-xml-c14n-20010315" />

<ds:SignatureMethod Algorithm="http://www.w3.org/2001/04/xmldsig-more#rsa-sha256" />

<ds:Reference URI="#M1727355916647">

<ds:DigestMethod Algorithm="http://www.w3.org/2001/04/xmlenc#sha256" />

<ds:DigestValue>NuDrebbMO7lzCWN5pypq5pLde9huVxRYUrOzu0UGNJE=</ds:DigestValue>

</ds:Reference>

</ds:SignedInfo>

<ds:SignatureValue>

rCgl9cFMYDsbro2acdbTCme0n4OK2cDTQxbug7ZHI5R1Nveyu1mb+h8aOZAm6Jhn2rc3OJeD3Qky

QMQ7QRKzCD4HQIPwpaBoI4Kk6PFwwk3aD/s9+WWfeJQVpZnRqcDZOlKdeoMvrHj6PYSBqGUIKtT2

/tKw6ygwcvnX5SBiVO5gZo4DReY8f+GOOBlLfqNFHtyVG+HTUATagpKzEiQBLlDuVsWksGkN5jk+

oFwoYlev8qB2f4niQEKFcT/KN16WszVlkVnRVcJvl8u7IGKhTv7wfzqnb/AXbf/Qq7n1uAioLbLF

RE25mHVt6z1138xkX6rlBbeQ4D/HU8SZSiXaDg==

</ds:SignatureValue>

<ds:KeyInfo>

<ds:X509Data>

<ds:X509Certificate>

MIIDxzCCAq+gAwIBAgIUDBt1MUWfMQnotsdXcrZ387CY4oQwDQYJKoZIhvcNAQELBQAwczELMAkG

A1UEBhMCRUUxCzAJBgNVBAgMAkhNMRAwDgYDVQQHDAdUYWxsaW5uMRMwEQYDVQQKDApNYWtzdSB0

ZXN0MQ8wDQYDVQQLDAYyMDAwMDIxHzAdBgNVBAMMFnZwb3N0ZXN0cy5tYWtzdXBheS5jb20wHhcN

MjQwNDMwMTE1NDA5WhcNMjgwNDI5MTE1NDA5WjBzMQswCQYDVQQGEwJFRTELMAkGA1UECAwCSE0x

EDAOBgNVBAcMB1RhbGxpbm4xEzARBgNVBAoMCk1ha3N1IHRlc3QxDzANBgNVBAsMBjIwMDAwMjEf

MB0GA1UEAwwWdnBvc3Rlc3RzLm1ha3N1cGF5LmNvbTCCASIwDQYJKoZIhvcNAQEBBQADggEPADCC

AQoCggEBAL81CItSrfk12TTOviXKXy+YQXker6UkpzTDf2ekzGpzA56fbZGgNnweby/RvZ2yGlSn

KoInWl0oZ8vLHDXXMpsdnAqL8MwOvbVN0otRTZ1W36Ca65e/0l2kTDwjTtl9CHaIYxN3F9vq9dlA

Y3euGpb0O6gBzGxCr2XIxHoGadB5vEfX9bfMYgswXYWOFxsAEu+lS4uo8bVa+L9reH0cU6aRbfMw

rzdSvUn/KazECN2VIXD7QPckkV8tksrj0hB38yMa188iU9vpZ1oePS662tQRkxjAsm4LcM4/3w18

Y/ky0emEWn14p/Yza0IWY1L04SrCEH4EPWKRSzy+RQixLT0CAwEAAaNTMFEwHQYDVR0OBBYEFMYo

d11iUYfyLbLd4HnF3tJwVkVlMB8GA1UdIwQYMBaAFMYod11iUYfyLbLd4HnF3tJwVkVlMA8GA1Ud

EwEB/wQFMAMBAf8wDQYJKoZIhvcNAQELBQADggEBAEB5FYdHlSDdrHdAJIsZMN1IuSDthH8dE1tv

HBZ5krHwwpXLBNMiyUaFC4G/f07dXpz9lRhgL25nMOM5mCHVCfTZ/FFTMaJdQi4yZcS9hZjkZwqp

pGp0+G8tGhI/bPW8n4tFnk1HK0FN9/d2jv1qqsWaIUdpHed7uz5OXMkzDdPjb8eO/QjfnJBHN+rm

z1UPvGN0cWATBNkbLiHkWvVM94Z+gVJGv9CnJCdn6xMD5O6uhkYn51LRYTb/yAyuyKhl9mY43U3G

A+/5r2UXQ3Ec8dhNNxvhr1WkQb0Hvuw6vpTf4BRy5MH/ermH5BJpFDoDNpJYUiSl+lxvCctsfNjJ

Xwo=

</ds:X509Certificate>

</ds:X509Data>

</ds:KeyInfo>

</ds:Signature>

</VPOS>

The response message general structure:

<VPOS xmlns="http://www.modirum.com/schemas/vposxmlapi5" xmlns:ns2="http://www.w3.org/2000/09/xmldsig#">

<Message id="M1727355916647" senderId="C=EE,ST=HM,L=Tallinn,O=ChaosPay,OU=E-COM Signer,CN=ChaosPay E-COM Signer 2024-01"

ts="2024-09-26T13:05:17.101Z" version="5.0">

<SaleRes errorCode="SE" orderId="O1727355899011" status="ERROR" txId="0">

<Description>Unexpected system error id 1727355917065</Description>

</SaleRes>

</Message>

<ds:Signature xmlns:ds="http://www.w3.org/2000/09/xmldsig#">

<ds:SignedInfo>

<ds:CanonicalizationMethod Algorithm="http://www.w3.org/TR/2001/REC-xml-c14n-20010315" />

<ds:SignatureMethod Algorithm="http://www.w3.org/2001/04/xmldsig-more#rsa-sha256" />

<ds:Reference URI="#M1727355916647">

<ds:DigestMethod Algorithm="http://www.w3.org/2001/04/xmlenc#sha256" />

<ds:DigestValue>Dbg+Kja0oQcSwTlThv9UeZzpTrzA9FmGsjik+EHh0Fs=</ds:DigestValue>

</ds:Reference>

</ds:SignedInfo>

<ds:SignatureValue>

rFhOMahqaMNDKcoAb5xf4QmXMDkUKvk2oeUmWI3A2NKnEIjafs3kA51/38i92GhT1+KRtR8qJKmd

qrytSqdNCr3CwYdhlGB2RyZrUE/zhSHUxWXFqrpFVH+Ikb4EYJ2ytakDrG7XzMdyJu9YKMsnakHB

W6xXyRJkC/P3b90R6myaQJRFJemGXGu75wJ/R+qmF6S5V/eRS2l18YuNX/3qMtINWQNALPfftxLQ

0ZKKNwT44XIU1GspK8jevPXmV52JkvSE+3uGu3a5t7RD8/7jgOgHa4yNeT7Zbe5OrCLlZsoW6Ypg

yyVmipG8UEH+h9lhSWIDn/+oeRO6BckuDKZL8FWxuFrA/GUdfWqbnznNrrA30jQEFhRrxVgGhN6g

PFnEgXPwUSvQLuYcNXryTR3wT3Ndi+Wsc3hvlfl4Ah6HbZMmu5S9m/+5AIqb6lDxsB4AGxDBi7UG

3jVswAq1uK0zGZPiPPtQGJ/J8wQ1tmJCx1Bb9ssESEQneYfRC1txM01f

</ds:SignatureValue>

<ds:KeyInfo>

<ds:X509Data>

<ds:X509Certificate>

MIIEczCCAtsCBGWfmh4wDQYJKoZIhvcNAQELBQAwfjEmMCQGA1UEAxMdQ2hhb3NQYXkgRS1DT00g

U2lnbmVyIDIwMjQtMDExFTATBgNVBAsTDEUtQ09NIFNpZ25lcjERMA8GA1UEChMIQ2hhb3NQYXkx

EDAOBgNVBAcTB1RhbGxpbm4xCzAJBgNVBAgTAkhNMQswCQYDVQQGEwJFRTAeFw0yNDAxMTEwNzM0

NTRaFw0yODAxMTAwNzM0NTRaMH4xJjAkBgNVBAMTHUNoYW9zUGF5IEUtQ09NIFNpZ25lciAyMDI0

LTAxMRUwEwYDVQQLEwxFLUNPTSBTaWduZXIxETAPBgNVBAoTCENoYW9zUGF5MRAwDgYDVQQHEwdU

YWxsaW5uMQswCQYDVQQIEwJITTELMAkGA1UEBhMCRUUwggGiMA0GCSqGSIb3DQEBAQUAA4IBjwAw

ggGKAoIBgQDI/pOZUHHlatYS/MV0i+xEMQE96tVFdRdbBesVa1P4Y1eiXITdvz5+8c2LEiBbYY6J

If4AHst0PuFlJSCYPBalEWNJTQCFOw09fHY9D3qhPoIixOM7WD46PGxbwU+Ld9y5ZfNthg+HBQ+F

OUCVcmXZ/id51FoyldValPlyjzea/5ydNhukfxIKG4zsDOa5Nn/EP2sS17MSMtTeDQbNT75asLTP

CURueVXDgAZDwTD4J3uGER4hxMAw/ybd32X0PA+MCMmNAUuLkWI1Y6SpRGELr8yFTnIYrvsFuoPM

qToLklq+E7YoJlWrDgdDXc3rGW5fu+Rk1NPRw8G6+tulkA416u2lOX5LaQkcA8ZQ3ZFHVegw7XUf

NmMycw2ofKTS5HA3nMwG4Ajr441PefTel0tKnX3qIJkBeBBTsUN+tPH7eZwz++Diru/oi435UFLg

zKdxfMc/KvjoEFw5nI1P2PZmKXnLfZbhqWxanKADzL1MRhrjCWJNo//B6puJasGDgoUCAwEAATAN

BgkqhkiG9w0BAQsFAAOCAYEAPTN5kuS/I6nsE5jBIr7zaxV7UM+ooSEdzFme6A83VvBIxJztyLMr

7kYJX6NQFbCSjIWdFs9uppKqW19VdutAhPrtLZHohdrWKHtEQOVppuarU8pNp2+MR5CAW9FmbJww

QAvh5BwJfmgIOUC+WZ5CCR5KEdPcizJwQV3j8iddysEyrdAUYetE/unZv291JtvpmTJpGu9nnb/r

cCLqbfCT/3mdxQ+idYvGCSKbEkPYfnlWm3rK9Z+BnRqsMHxmteDYlB6EHdNLzOzf/N3IKkwxrtld

Cm5VLx2XbvpP40vBs48yny++I+4aa2dhMAJNlg4YMtB1fRbJI7A9IBxWRuNQwX1wAX6mnyOF3loO

+KlCV5jezX7TjA97GTrSR0O4Zr0w3S1D4/dDctnlnOfQlE3/sFyTmzjwNoMzgBxhlhcRU6Tohb27

HJDV0yJRb27dX9SowapkUIKYhJ+zAxkWaIU3uHPAOiWp73e7p5yPCvRoYjZZDlKyGi1l2iOh+iGk

B3rI

</ds:X509Certificate>

</ds:X509Data>

</ds:KeyInfo>

</ds:Signature>

</VPOS>

The general error message structure (returned in case request: message was unparseable or unvalidatable)

<VPOS>

<Message version="5.0" id="12345">

<ErrorMessage>

<ErrorCode></ErrorCode>

<Description></Description>

<OriginalXML></OriginalXML>

</ErrorMessage>

</Message>

</VPOS>

The exact xml bindings are defined in xsd schema.

https://pay.test.maksupay.com/vpos/xsd/VPOS5.xsd

Description of request and response message elements and fields and their usage:

Note JSON messages are identical to XML except element attributes are then JSON objects and properties respectively. Also JSON messages missing Signature object as this is sent in http headers and calculated over message body being posted.

| Field/request | Type | Description |

|---|---|---|

| Request | ||

| VPOS | element | XML root element / JSON root { } |

| Message | element type Message | Message contents element / JSON Object “message” |

| version | attribute, xsi:string | Message version default value “5.0” |

| id | attribute, xsi:ID | Message unique identifier (values in request and reply messages this must match, also used for lookup signature reference object when validating signature) (“M1234567”) |

| lang | attribute, xsi:string(2) | Message attribute to specify context language (Optional)

(ISO 639-1 language code en, fi, sv, el, etc..) |

| ts | Attribute xsi:dateTime | Approximate time when message was created |

| senderId | attribute, xsi:string | In Requestes merchant service account id (merchant number) |

| Signature | element ds:SignatureType |

Required if version = 5.0 (only supported version) The xml signature as defined https://www.w3.org/TR/xmldsig-core/ Canonicalization http://www.w3.org/TR/2001/REC-xml-c14n-20010315 SignatureMethod Algorithm=”http://www.w3.org/2001/04/xmldsig-more#rsa-sha256” DigestMethod Algorithm=”http://www.w3.org/2001/04/xmlenc#sha256″ Requests are signed by merchant private ket and validated with merchant Certificate and responses are signed by processor private key and validated with Processor certificate |

|

Payment API messages SaleReq, AuthorisationReq, CaptureReq, OriginalCreditReq RefundReq, CancelReq RecurringOperationReq, StatusReq, TokenizationReq, DeTokenizationReq |

element | RequestMessage element depending on request type

Equvalent JSON objects: saleReq,authorisationReq, originalCreditReq, refundReq, cancelReq recurringOperationReq, statusReq, tokenizationReq, deTokenizationReq |

| merchantId | attribute | Merchant number/identification in VPOS=Message senderId |

| OrderInfo | Orderinfo element of request Message / JSON Object orderInfo | |

| OrderId | xsi:string AN1..50 | Merchant defined unique order id / JSON string orderId |

| OrderDesc | xsi:string AN1..4000 | Order description defined by Merchant / JSON string items |

| OrderAmount | xsi:decimal (max 9+3 or 10+2) | Order amount (decimal number >0.0 and max 12 digits + decimal point) /JSON number orderAmount |

| Currency | xsi:string A3 | ISO4217 alphabetic currency code (USD, EUR) / JSON string currency |

| PayerName | xsi:string AN1..64 | Order payer full name (string..64) /JSON string payerName |

| PayerEmail | xsi:string AN1..64 | Order payer email address (string..64) /JSON string payerEmail |

| PayerPhone | xsi:string N1..30 | Order payer phone number, optional but strongly recommended (string..30) /JSON string payerPhone |

| Elements Var1..Var9

Var1, Var2, Var3, Var4, Var5, Var6, Var7, Var8, Var9 |

xsi:string AN1..4000 | Free variable defined by merchant or items.

/JSON strings var1,var2,var3,var4,var5,var6,var7,var8,var9 |

| MOTO | xsi:integer N1 | Indicating whether it is a MOTO transaction (1

indicates MOTO) /JSON number moto |

| Weight | xsi:decimal | Order shipping weight (kg) if item is shippable and shipping needs to be calculated by VPOS (decimal number >0) and it is supported /JSON number waight |

| Dimensions | xsi:string AN1..25 | Order shipping dimensions (mm) in format width:height:depth for example a box 200:200:200 (string..25) can be used for shipping calculation if implemented so

/JSON string dimensions |

| BillingAddress | element address | Element of OrderInfo / JSON Object billingAddress |

| Country | xsi:string AN2 | Billing address country code (string 2 ISO 3166-1-alpha-2 code (US, FI, GB)) /JSON string country |

| State | xsi:string AN1..50 | Billing address state (string..50) /JSON string state |

| Zip | xsi:string AN1..16 | Billing address zip code (string..16) /JSON string zip |

| City | xsi:string AN1..64 | Billing address city (string..64) /JSON string city |

| Address | xsi:string AN1..100 | Billing address street (string..100) /JSON string address |

| ShippingAddress | element:address | Element of OrderInfo / JSON Object /JSON object shippingAddress |

| Country | xsi:string AN2 | Shipping address country code (string 2 ISO 3166-1-alpha-2 code (US, FI, GB)) Optional, required when parameter weight or dimensions are present. /JSON string country |

| State | xsi:string AN1..50 | Shipping address state (string..50) Optional, required when parameter weight or dimensions are present. /JSON string state |

| Zip | xsi:string AN1..16 | Shipping address zip code (string..16) Optional, required when parameter weight or dimensions are present. Optional, required when parameter weight or dimensions are present. /JSON string zip |

| City | xsi:string AN1..64 | Shipping address city (string..64) Optional, required when parameter weight or dimensions are present. /JSON string city |

| Address | xsi:string AN1..100 | Shipping address street (string..100) Optional, required when parameter weight or dimensions are present. /JSON string address |

| PaymentInfo | Payment info element of request / JSON Object paymentInfo | |

| PayMethod | xsi:string AN1..20 | Card brand VISA, MasterCard others are defined on site

valid values are visa for VISA cards, mastercard for MasterCard /JSON string payeMethod |

| Card | Element CardData | Object type CardData |

| PAN | xsi:string N11..19 | Card number /JSON string cardPan |

| expDate | xsi:string N4 | Card expiration date in format YYMM /JSON string cardExpDate |

| holderName | xsi:string AN1..24 | Card holder name /JSON string cardHolderName |

| CVV2 | xsi:string N3..4 | CVV2/CVC2 security code from card./JSON string cardCvv2 |

| CENC | Xsi:string ..2048 | In case on merchant merchant site user browser RSA card data encryption is used this field contains encrypted card data in form of Base64(RSA(UTF8Bytes(“pn={pan}&ey={exp year}&em={exp month}&c2={cvv2}&cn={cardholdername}”))

Values are urlencoded and with utf-8 char encoding (with javascript encodeURIComponent). This all is handled by server supplied component, merchant just need to forward value as returned to this field content. If this field is present then fields CardPan, CardExpDate, CardHolderName, CardCvv2 must not be bresent /JSON string cardEncData |

| WalletInfo | element | A wallets extension element if merchant inititated the xml api payment with Wallets |

| walletId | Attribute, required | Indigting wallet type id GooglePay for GooglePay™ , ApplePay for ApplePay™, from walletId of walletData |

| status | Attribute, required | This shall be value of “success” |

| data | Element, required | The “data” value from MaksuPay SDK response walltetData object, this contains full payload or content as is returned by GooglePay or ApplePay SDKs |

| RecurringFrequency | xsi:string N1..3 | A value indicating the number of days between the recurring payments. 28 is a special value indicating a month. /JSON number Recurringferequency |

| RecurringEndDate | xsi:string N8 | Recurring end date Format yyyymmdd

/JSON string Recurringenddate |

| InstallmentParameters | element | Installments parameters element /JSON object installmentParameters |

| InstallmentOffset | xsi:integer N1..2 | Defines the number of months between the entering of the transaction, n case installment payment

/JSON number Installmentoffset |

| InstallmentPeriod | xsi:integer N1..2 | Defines the number of monthly payments in case installment payment. Valid value must be >1

/JSON number Installmentperiod |

| ExtXOrderId | xsi:string AN1..50 | Optional merchant and acquirer agreed extension for recognizing returning customers with submitting previous successful order id of the merchant recognized customer. If functionality is not enabled for merchant this parameter is silently ignored. And if in such case CardPan is missing or is not valid error condition will be generated. Also used in original credit to locate original payment.

/JSON string extXOrderId |

| ExtTokenOptions | Xsi:string N1 | Optional for merchant and acquirer agreed token extension Value 1 if request tokenization and PAN is supplied.

/JSON string extTokenOptions |

| ExtToken | Xsi:string N12..19 | Optional merchant and acquirer agreed token extension for recognizing payment tokens from previous successful payments.

/JSON string extToken |

| AddFraudScore | xsi:integer | Incoming starting risk score (integer) /JSON number addFraudScore |

| BlockScore | xsi:integer | Optional block score parameter that will be used to block the transaction if transaction riskScore reaches this value or above. (Postive Integer number) /JSON number blockScore |

| ThreeDSecure | element | In case of merchant is processing 3D secure prior to sending payment reequest this field shall be included, this is also included in AuthRes,AuthResultsRes

JSON object threeDSecure |

| CAVV | elem xsi:string AN28 | In case of merchant is processing 3D secure prior to sending this xml message this field should contain 3D secure CAVV if authenticated. Base64 encoded value (28 chars) of CAVV of value of 20 bytes |

| tdsTransID | elem xsi:string AN40 | Three D Server transaction id |

| dsTransID | Elem xsi: string AN40 | DS Servier transaction id |

| acsTransID | Elem xsi: string AN40 | ACS transaction id |

| eci | attr xsi:string N2s | message this field can optionally contain ECI value |

| protocol | attr xsi:string | Required if not 3DS1, value from MPI responses

values 3DS1.0.2, 3DS2.1.0 |

| transStatus | Attr xsi:string | Transaction final authentication status |

| transStatusReason | Attr xsi:string | Transaction status reason |

| authMethod | Attr xsi:string | Transaction authentication method |

| Attribute | elem AttributeType 0..n counts | Extra attributes for 3DS2

add all attibutes with names challengeCancel … And any other 3DS2 defined attribute |

| TransactionInfo | element | Transaction info element (used in recurring cancel operation present in RecurringOperationRequest only)

/JSON Object transactionInfo |

| orderId | Attr xsi:string AN1..50 | Merchant defined unique order id (of original payment)

/JSON string orderId |

| txId | Attr Xsi:long | txId applicable in StatusRequest messsgae only

/JOSN number txId |

| Operation | xsi:string AN1..25 | Predefined String value, Currently supported operation :

Cancel (to cancel recurring occurring) Recurring to execute recurring in series |

| Responses/ Notification | ||

| VPOS | element | XML root element |

| Message | element type Message | Message contents element |

| version | attribute, xsi:string | Message version default value “5.0” Required |

| id | attribute, xsi:ID | Message unique identifier (values in request and reply messages this must match, no other purpose) |

| lang | attribute, xsi:string (2) | Message attribute to specify context language (Optional)

(ISO 639-1 language code en, fi, sv, el, etc..) |

| senderId | attribute | Message sender id (Maksu CN) |

| ts | Attribute xsi:dateTime | Message timestamp when approximate time of when message was created. Example 2015-04-30T12:21:02.402 +03:00 |

| Signature | element ds:SignatureType | The xml signature as defined https://www.w3.org/TR/xmldsig-core/

Canonicalization http://www.w3.org/TR/2001/REC-xml-c14n-20010315 SignatureMethod Algorithm=”http://www.w3.org/2001/04/xmldsig-more#rsa-sha256” DigestMethod Algorithm=”http://www.w3.org/2001/04/xmlenc#sha256” On JSON messages signature is missing, but is sent on http header and calculates over exact contents posted. |

| All Responses | element | XML Element of response type and named as

SaleRes, AuthorisationRes, CaptureRes, OriginalCreditRes, RefundRes, CancelRes, RecurringOperationRes Or JSON objects saleRes, authorisationRes, captureRes, originalCreditRes, refundRes, cancelRes, recurringOperationRes |

| merchantId | attribute | Merchant account id |

| status | attribute | Result status

Transaction status in response or notficiation messages AUTHORIZED, CAPTURED – payment was successful (accept order) REFUSED – payment failed, payment was denied for card or by bank (deny order) REFUSEDRISK – payment failed, payment was denied for card by risk score (deny order) CANCELED – only in recurring operation response if supsequent recurrings are set to be canceled |

| errorCode | attribute | In case of errors |

| Description | element/string 255 | Response/Outcome descrptive text |

| PaymentResponses/Notifications | ||

| orderId | Attribute xsi:string | Same value as in request message OnrderInfo |

| txId | xsi:long | txId if transaction is related to action/payment or 0 in case of errors / Server supplied transaction id |

| Currency | xsi:string | Same value as in request message OnrderInfo |

| PaymentTotal | xsi:decimal | Actual payment amount normally equals orderAmount or orderAmount + any fees if applicable |

| Sequence | Xsi:integer | Used with recurrings |

| PaymentRef | Xsi:string | Remote payment reference like issue approval code. |

| RiskScore | xsi:integer | Optional risk score calculated by risk scroring subsystem if available |

| ExtToken | Xsi:string | Optional payment token if tokenization was requested and performed |

| ExtTokenPanEnd | Xsi:string | Optional payment token related PAN ending 4 numbers |

| ExtTokenExp | Xsi:date | Optional payment token expiration. (YYYY-MM-DDZ)

example 2018-02-01+02:00 |

| ReqcurringNotification | ||

| OrderAmount | Element xsi:decimal | Same value as in request message OnrderInfo |

| Currency | Element xsi:string | Same value as in request message OnrderInfo |

| PaymentTotal | Element xsi:decima | Actual payment amount normally equals orderAmount or orderAmount + any fees if applicable. |

| PaymentRef | El Xsi:string | Remote payment reference like issue approval code |

| Description | El Xsi:string | Error or result description text |

| Sequence | Xsi:integer | Recurring sequence number |

| status | Attribute xsi:string |

Transaction status in response or notification messages AUTHORIZED, CAPTURED – payment was successful (accept order) REFUSED – payment failed, payment was denied for card or by bank (deny order) CANCELED – only in recurring operation response if subsequent recurring are set to be canceled ERROR – input, system or network error (deny order) |

| seqTxId | attribute Xsi:long | The recurring sequence transaction server supplied id |

| txId | Attribute Xsi:long | Server supplied transaction id of recurring master that started recurring sequence |

| errorCode | attr Xsi:string | Error code |

| Attribute | Complex element

many |

|

| StatusRequest | Query for transaction status | |

| merchantId | Attribute element | Merchant number/identification in VPOS |

| TransactionInfo | element | |

| orderId | attr Xsi:string | Use either order id ot txid to query results if order id used then all transactions referenced are included such as captures, refunds associated |

| txId | attr Xsi:long | Use txId to query by txId, only single transaction data is returned |

| StatusResponse | Response of transaction status conaining one or many TransactionDetails | |

| merchantId | attribute | |

| orderId | attribute | |

| txId | attribute xs:long | Transaction identifier |

| status | attribute | |

| errorCode | attribute | |

| Description | element | |

| TransactionDetails | element | One or many |

| orderId | attribute | required |

| txId | attribute | required |

| OrderAmount | Element xs:decimal | Merchant submitted order amount |

| Currency | Element xs:string | Order currency |

| PaymentTotal | Element xs:decimal | Final payment amount (order +/- adjustments, fees etc) |

| Sequence | Element xs:integer | In case of recurring |

| PaymentRef | Element xs:string | Payment reference or approval code if available |

| RiskScore | Element xs:integer | Risk score if available |

| TxType | Element xs:string | Transaction type |

| TxDate | Element xs:dateTime | Transaction execution timestamp |

| TxStarted | Element xs:dateTime | Transaction started timestamp |

| TxCompleted | Element xs:dateTime | Transaction completed timestamp |

| PaymentMethod | Element xs:string | Payment method used |

| Attribute | Complex element

many |

Many, rest of the transaction data. As |

| ErrorMessage | element | Response type of ErroMessage, normally given if request message validation failed or system error. |

| errorCode | Attribute Xsi:string | Error code |

| Description | El Xsi:string | Error description text |

| OriginalMsg | El Xsi:string | Encoded original XML/JSON received in case the error was in content parsed |

Table of field requirements depending on messages:

R – required, O-optional, C-conditional

| Field element/

requests |

Sale/ AuthorizationRequest | TokenizatationRequest | DeTokenizationRequest | CaptureRequest | OriginalCreditRequest | RefundRequest | CancelRequest | RecurringOperationRequest | SaleResponse | AuthorisationResponse | CaptureResponse | OriginalCreditResponse | RefundResponse | CancelResponse | RecurringOperationResponse | RecurringNotification | Description |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Message | |||||||||||||||||

| version | R | R | R | R | R | R | R | R | R | R | R | R | R | R | R | R | 5.0 |

| id | R | R | R | R | R | R | R | R | R | R | R | R | R | R | R | R | Unique value of numbers and or chars xsi:ID and matching in request, response messages. max length 128 |

| lang | O | O | O | O | O | O | O | O | O | O | O | O | O | O | O | O | Optional iso language code as el, en, ru, fi, et, sv. This is used to set context language in case emails or any other type actions are triggered with this request |

| ts | R | R | R | R | R | R | R | R | R | R | R | R | R | R | R | R | Timestamp Required in V5.0 |

| senderId | R | R | R | R | R | R | R | R | R | R | R | R | R | R | R | R | |

| OrderInfo | R | R | R | R | R | ||||||||||||

| orderId | R | R | R | R | R | ||||||||||||

| OrderDesc | O | O | |||||||||||||||

| OrderAmount | R | R | R | R | R | ||||||||||||

| Currency | R | R | R | R | R | ||||||||||||

| Var1 | O | O | |||||||||||||||

| Var2 | O | O | |||||||||||||||

| Var3 | O | O | |||||||||||||||

| Var4 | O | O | |||||||||||||||

| Var5 | O | O | |||||||||||||||

| Var6 | O | O | |||||||||||||||

| Var7 | O | O | |||||||||||||||

| Var8 | O | O | |||||||||||||||

| Var9 | O | O | |||||||||||||||

| MOTO | |||||||||||||||||

| Weight | |||||||||||||||||

| DImensions | |||||||||||||||||

| BillingAddress | O | optional billing address element and sub element, may be required depending on Acquirer | |||||||||||||||

| ShippingAddress | O | optional shipping address element and sub element | |||||||||||||||

| PaymentInfo | R | O1 | O1 | O1 | O1 – optional if system set up supports | ||||||||||||

| PayMethod | R3 | O1 | O1 | O1 | O1 – optional if system set up supports

R3 – normally required but may be omitted if system is set up so |

||||||||||||

| Card | R | Card object type CardData, required if card payment | |||||||||||||||

| PAN | R2 | O1 | O1 | O1 | O1 – optional if system set up supports, R2 – optional if system set up supports, Not present if ENC present | ||||||||||||

| ExpDate | R | O1 – optional if system set up supports, Not present if CardEncData present | |||||||||||||||

| CVV2 | C | Required if not MOTO and required for card type/brand,

Not present if CardEncData present. |

|||||||||||||||

| HolderName | R | Cardholder name, required if Card element prcent | |||||||||||||||

| Or CENC | C | Used if RSA card encryption then Pan, ExpDate, HolderName and CVV2 shal not be present but are in CardEnc encrypted | |||||||||||||||

| Or Token | C | If a token is used instead of PAN | |||||||||||||||

| Or WalletInfo | C | Depends on wallet case | |||||||||||||||

| walletId | C | Required if WalletInfo present | |||||||||||||||

| status | C | “success” required, if WalletInfo present | |||||||||||||||

| data | C | Required if if WalletInfo present | |||||||||||||||

| PayerName*

PayerPhone |

O |

PayerName applicable for non card payments* else in card data Optional but highly recommended. Not present if CardEncData present. |

|||||||||||||||

| PayerEmail | R | Payer email required | |||||||||||||||

| PayerIpAddress | R | Payer ip address | |||||||||||||||

| ExtXOrderId

ExtTokenOptions |

O2 | R | O2 – may be present instead of CardPan if system set up supports. Required for original credit to lookup source payment. | ||||||||||||||

| RecurringParameters | C | Required for recurring payment | |||||||||||||||

| RecurringFreq | C | Required for recurring payment | |||||||||||||||

| RecurringEndDate | C | Required for recurring payment | |||||||||||||||

| InstallmentParameters | C | Required for installment payment | |||||||||||||||

| InstallmentOffset | C | Required for installment payment | |||||||||||||||

| InstallmentPeriod | C | Required for installment payment | |||||||||||||||

| TransactionInfo | R | ||||||||||||||||

| OrderId | R | ||||||||||||||||

| Operation | R | ||||||||||||||||

| Signature | R | R | R | R | R | R | R | R | R | R | R | R | R | R | R | Required for all | |

| Attribute el name=”txId” | C | Depends on wallet case | |||||||||||||||

| Attribute el name=”walletId” | C | Depends on wallet case | |||||||||||||||

| Attribute el name=”authMethod” | C | Depends on wallet case | |||||||||||||||

| Card | R | CardInfo | |||||||||||||||

| Token | R | TokenInfo | |||||||||||||||

| Responses/Notification | |||||||||||||||||

| orderId | R | R | R | R | R | R | R | R | Order Id supplied by merchant originally | ||||||||

| OrderAmount | R | R | R | R | R | R | R | ||||||||||

| PaymentTotal | R | R | R | R | R | R | R | ||||||||||

| Currency | R | R | R | R | R | R | R | ||||||||||

| Status | R | R | R | R | R | R | R | R | Status | ||||||||

| TxId | C | C | C | C | C | C | R | In case of transaction processing has started (no rejection due invalid input request), In case of recurring Notificatuion this is master recurring transaction id | |||||||||

| Sequence | R | Sequence of recurring in notification | |||||||||||||||

| SeqTxId | R | The executed recurring sequence transaction id | |||||||||||||||

| PaymentRef | C | C | C | C | C | C | C | Payment reference such as approval code if available | |||||||||

| RiskScore | O | O | Optional risk score calculated by risk scoring subsystem if available | ||||||||||||||

| errorCode | C | C | C | C | C | C | C | C | Error code in case of Status=ERROR | ||||||||

| Description | O | O | O | O | O | O | O | O | Optional error description | ||||||||

| Attribute | O | O | O | O | O | O | O | O | Optional attributes, may be custom per implementation | ||||||||

| OriginalMsg | In general error message only to copy back the erroneus content received for merchant debugging. | ||||||||||||||||

| Signature | R | R | R | R | R | R | R | R | Required for all XML |

StatusRequest/StaturResponse

| Field element/

requests |

StatusRequest | TokenizationRequest | DeTokenizationRequest | StatusResponse | TokenizationResponse | DeTokenizationResponse | Description |

|---|---|---|---|---|---|---|---|

| StausRequest | |||||||

| merchantId | R | R | R | ||||

| TransactionInfo | R | ||||||

| orderId | C | Either OrderId or TxId is required | |||||

| txId | C | Either OrderId or TxId is required | |||||

| StatusResponse | R | ||||||

| TransactionDatails | R | ||||||

| OrderAmount | R | ||||||

| Currency | R | ||||||

| PaymentTotal | R | ||||||

| Status | R | ||||||

| TxId | R | ||||||

| PaymentRef | O | ||||||

| Description | O | ||||||

| TxType | R | ||||||

| TxDate | R | Transaction exec date | |||||

| TxStarted | R | Transaction started | |||||

| TxCompleted | O | May be missing if transaction did not complete due errors | |||||

| Attribute | O |

|

List of attributes depending on what information is available. Attribute name can be one of the following: MERCHANT NO – merchant number, REFUNDED AMOUNT – amount refunded if availble, USER IP – use ip if available, CHANNEL – channle originated 3D STATUS – status CAPTURED AMOUNT – captured amt SETTLEMENT FILE – settl file name BATCH NO – batch number ISO response code – iso response if available ExtData – additional data from external payment systems if available ORDER DESCRIPTION – order descr CARD MASK PAN – masked pan 5+3 or 4+4 or 6+2 INSTALLMENT SEQUENCE, INSTALLMENT PERIOD, INSTALLMENT OFFSET, RECURRING SEQUENCE, RECURRING END DATE, RECURRING FREQUENCY, ECOM-FLG – ecom flag in auth message, ECI – eci from mpi, VAR1..VAR9, PAYEREMAIL, PAYERPHONE, BILLCOUNTRY, BILLSTATE, BILLZIP, BILLADDRESS SHIPCOUNTRY, CancelRequest RecurringOperationRequest, StatusRequest, TokenizationRequest, DeTokenizationRequestSHIPSTATE SHIPZIP SHIPADDRESS

BONUS PARTICIPATION*, BONUS REF* BONUS ADJUSTMENT* BONUS STATUS* BONUS DETAILS*

RETURNING USED** RETURNING ORDER ID** * – Only possible if with special bonus loyalty extension. ** – Only possible if with returning customer extension. |

||||

| Card | R | R | R | CardInfo type ref required, if CSE then encData reuired else pan,exp reuired | |||

| Token | R | R | R | ||||

| id | R | R | R | R | R | ||

| status | R | R | |||||

| statusMessage | O | O |

O1 – if supported feature then fields may not need to be present if not supported then the fields are required. Availability of this option shall confirmed with system administrator (Your customer support). If values not sent then whole PaymentInfo element shall be excluded from message.

R2 and O2 – If system supports and merchant is set tp participate in returning customer recognition extension then if merchant already has a successful order with a card with this customer and the card is still valid and customer chooses to make this next order with same card and the days and amounts between orders are in certain limits then merchant may send ExtXOrderId instead of CardPan. In such case if validations are passed system automatically uses pan from previous specified order. Recommended maximum period between previous order and next returning customer extension order could be 6 months (180 days).

R3 if acquirer/processor has set up so then PayMethod may be omitted. Default required and recommended.

Currently supported operations:

AuthorisationReq -make a pre authorization

CaptureReq – capture a pre authorization

RefundReq – make refund

SaleReq – make a payment

CancelReq – make reversal for an unsettled transaction

RecurringOperationReq – with operation Cancel, cancel recurring master scheduling

RecurringNotification – Optional message posted to merchant if a recurring child is executed on server, merchant does not need to send response XML to this on accept merchant server should respond with http status code 200/OK or in case merchant does not recognize the transaction 406/Not Acceptable or 400/Bad Request if the message format is invalid. Server just acknowledges the response code and performs no additional actions based on merchant response code.

StatusReq – query transaction status

TokenizationReq – tokenize a card to token

DeTokenizationReq – de tokenize a token back to card date

Error code values:

Filled in case status is ERROR with following values

M1 – Invalid merchant id

M2 – Authentication failed (wrong password or digest or signature)

SE – System error (message contains error id, system or configuration error to be investigated)

SD – Service disabled (service disabled)

XE – Invalid XML/JSON request not parseable or does not validate

I0 – Invalid or unsupported request

I1 – Message contains invalid data item or missing required item

I2 – Message contains invalid installment parameters

I3 – Message contains invalid recurring parameters

I4 – Message contains invalid or mismatching card data

I5 – Message contains invalid expiration date card data

I6 – Selected payment method does is not supported or not matching the payment card

O1 – Operation is not allowed because logic is violated or wrong amounts

O2 – Original transaction is not found to perform operation.

May be also filled in case of status is REFUSED

with acquirer network supplied ISO response code

3.2 3D-Secure API

Maksu 3DS Secure API facilitates 3DS 2 authentication via its simple API to utilize 3DS Server services.

Endpoints both XML or JSON:

Production: https://pay.eu.maksupay.com/vpos/vposapi

Sandbox: https://pay.test.maksupay.com/vpos/vposapi

Messages structure is identical to Payments API except the functional messages used are different.

| Field/request | Type | Description |

|---|---|---|

| Request | ||

| VPOS, Message, Signature etc | See description in payments API section | |

|

3DS API messages: TDSMethodReq/TDSMethodRes AuthReq/AuthRes AuthResultsReqAuthResultsRes |

element | RequestMessage element depending on request type

Equvalent JSON objects: tdsmethodReq/tdsmethodRes authReq/authRes, authResultsReqReq/ authResultsReqRes |

| ThreeDSMethodReq | El, Message object | Message to check if Three DS method applies for card range |

| PaymentInfo | ||

| Card | Element CardInfo | Object type CardInfo |

| PAN | xsi: string N11..19 | Attribute Card number /JSON string PAN |

| expDate | xsi:string N4 | Attribute Card expiration date in format YYMM /JSON string expDates |

| holderName | xsi:string AN1..24 | Attribute Card holder name /JSON string holderName |

| or

WalletInfo |

Object type WalletInfo | |

| walletId | Attribute, required | Indigting wallet type id GooglePay for GooglePay™ , ApplePay for ApplePay™, from walletId of walletData |

| status | Attribute, required | This shall be value of “success” |

| data | Element, required | The “data” value from walltetData returned by Maksu SDK. This contains full payloas of GooglePay or ApplePay SDK returned data, including encrypted token. |

| orderId | attribute/property | Required |

| merchantId | attribute/property | Required |

| ThreeDSMethodRes | El, object | Response to Three DS Method request |

| ThreeDSMethodContent | El, xsi string | Html content to be rendered in browser |

| orderId | attribute | Same as in response |

| refId | Attribute xsi:long | Transaction id, for later requests in relation to that aurthentication transaction with that pan |

| merchantId | Attribute | required |

| status | attribute | required |

| errorCode | Present when error | |

| Description | Element xsi string | Action result description text |

| AuthenticationReq | element | Authentication request message |

| OrderInfo | Element object | See description at Payment API |

| PaymentInfo | Element object | See description at Payment API |

| sessionData | Element xsi:string | A session identifier to recognize tx in callBackURL |

| callBackURL | Element Xsi string |

Callback url to call when 3DS authentication session is completed ad issuer. Recommended implementation is that this value is set to “javascript” and instead of callback url API service rendered contenr calls a javascript postMessage function to inform parett window / frame about 3ds window ended/closed In case of javascript content posted with window.sendMessage function is JSON data: { “sd” : “sessionData”, “status” : “status” } sessionData is same value send in that request, status can have values: SUCCESSS – 3ds authentication succes UNABLE – 3ds authentication “U” cases ERROR – authentication error FAIL – authntication failure If callBackURL was url service makes http POST with parameters sd=sessionData status=status with same values as in json message in case of javascript |

| Attribute | Element

AttributeType |

Many, 3ds2 related data attributes and values |

| name | Atrribute name | The attribute name eg:

TDS2_BrowserIP, TDS2_BrowserAccept, TDS2_Navigator_language, TDS2_Navigator_javaEnabled, TDS2_Navigator_jsEnabled, TDS2_Screen_colorDepth, TDS2_Screen_height, TDS2_Screen_width, TDS2_Screen_pixelDepth, TDS2_TimezoneOffset, TDS2_UserAgent |

| AuthenticationRes | El object | Response to AuthenticationReq |

| ThreeDSecure | Element object | |

| CAVV | El, xsi string | Peresent on authentication success or proof of attempt cases |

| tdsTransID | Attr xsi: string | 3DS Server trans id |

| dsTransID | Attr xsi: string | Directory server trans id |

| acsTransID | Attr xsi: string | ACS trans id |

| ECI | Attr xsi string | 3DS E commerce indicator |

| protocol | Attr xsi string | Authentication 3DS Protocol and version indicator |

| transStatus | Attr xsi string | Authentication status |

| transStatusReason | Attr xsi string | Authentication status reason |

| authMethod | Attr xsi string | Authentication method |

| Attribute | Element

AttributeType |

0…Many, 3ds2 related data attributes and values, depends on protocol requirements |

| ThreeDSMethodContent | Xsi: string | Present if TDSMethodReq call was omitted, but required for card range, then Three DS method content is to be rendered in browser iframe and then continue with AuthenticationReq having set same orderId and same pan |

| ThreeDSContent | Xsi: string | Present if authentication challenge flow is required, the content is to be rendered in browser iframe in ralation to main payment page. |

| orderId | Attribute, Xsi: string | Original merchant orderId |

| refId | Attribute, xsi:long | Authentication transaction record identifier |

| merchantId | Attribute | required |

| status | attribute | required |

| errorCode | attribute | Present when error |

| Description | Element xsi string | Action result description text |

| AuthResultsReq | El object | Authentication results request to query final authentication outcome after challenge flow is completed. |

| refId | Attribute, xsi:long | Authenticatoin transaction record identifier, required |

| merchantId | Attribute | required |

| AuthResultsRes | El object | Authentication results response with authentication data if authentication was successful |

| orderId | Attribute, Xsi: string | Original merchant orderId |

| refId | Attribute, xsi:long | Authentication transaction record identifier |

| merchantId | Attribute | required |

| status | attribute | required |

| errorCode | attribute | Present when error |

| Description | Element xsi string | Action result description text |

| ThreeDSecure | Element object | |

| CAVV | Attr, xsi string | Present on authentication success or proof of attempt cases |

| tdsTransID | Attr xsi: string | 3DS Server trans id |

| dsTransID | Attr xsi: string | Directory server trans id |

| acsTransID | Attr xsi: string | ACS trans id |

| ECI | Attr xsi: string | 3DS E commerce indicator |

| protocol | Attr xsi: string | Authentication 3DS Protocol and version indicator |

| transStatus | Attr xsi: string | Authentication status |

| transStatusReason | Attr xsi: string | Authentication status reason |

| authMethod | Attr xsi: string | Authentication method |

| Attribute | Element

AttributeType |

Many, 3ds2 related data attributes and values, depends on protocol requirements |

Status values in for authentication request responses:

INITIAL – authentication initialization stage, use ThreeDSMethodContent and include to payment page.

NOTDSMETHOD – no three ds method for card, continue with authentication flow

INTDSMETHOD – internal status, authentication in 3ds method (not returned in message)

INTDSMETHODC – authentication in 3ds method, continue to authentication flow

INAUTH – internal status that authentication in porgress (not returned in message)

REJECTED – authentication failed with reject status “R”

AUTHFAIL – authentication failed with not authenticated “N” status

AUTHWALLET – applicable response when wallet date used to check 3ds reuirements, this status meaning wallet had 3ds cryptogram and not 3ds needed.

UNAVAILABLE – authentication failed with unavailable “U” status

CHALLENGE – authentication challenge was requested, use ACS redirect content to redirect user to authentication at issuer ACS.

COMPLETED – authentication completed with fully authenticated “Y” or attempt “A” astatus.

ERROR – error found or occurred in processing or validating data.

3.3 Signature calculation with XML API V5.0

Signatures shall be calculated and verified according to documentation https://www.w3.org/TR/xmldsig-core/

Canonicalization method to be used is http://www.w3.org/TR/2001/REC-xml-c14n-20010315

SignatureMethod Algorithm=”http://www.w3.org/2001/04/xmldsig-more#rsa-sha256”

DigestMethod Algorithm=”http://www.w3.org/2001/04/xmlenc#sha256”

The signed element is Message element referenced with its ID attribute named id.

ID attribute is an attribute which type in schema is defined as xsd:ID.

Messages sent by merchant are signed by merchant private key and verified with merchant certificate public key.

Messages sent by VPOS processor service are signed by service provider private key and validated with service provider provided certificate public key.

The canonicalization method to be used is

http://www.w3.org/TR/2001/REC-xml-c14n-20010315

Note that the XML documents should be handled with namespace aware xml libraries (parser/serializer).

When the Message element is serialized and canonicalized it should contain xmlns namespace attribute.

See from next section XML message with digest/signature example.

Note for XML/JSON API with Three D Secure:

This is 2 step processing at first step merchant should implement 3DS api session as described in 4.2 3D Secure API and obtain the Three D Secure authentication results from there and then next step is to fill the corresponding values to XML/JSON API ThreeDSecure element and proceed with XML/JSON api payment request to VPOS.

3.4.1 Using VPOS client side encryption for API messages

Merchants who want to use option of browser RSA card data encryption need to import service provider javascript to their payment page.

Client side encryption java script is to be imported from url like:

Production:

<script type="text/javascript" src="https://pay.eu.maksupay.com/vpos/csescript.js?version=5&mid=1234567&date=201804271539&signature=xxxxx”>

Sandbox:

<script type="text/javascript" src="https://pay.test.maksupay.com/vpos/csescript.js?version=5&mid=1234567&date=201804271539&signature=xxxxx”>

</script>

with following query parameters to authenticate request

| Field (HTTP GET parameter ) | Required / Optional | Description |

|---|---|---|

| version | R | Version 5 |

| mid | R | Merchant id supplied (integer number) max length 30 |

| date | R | Current date and time in format YYYYMMDDHHMM |

| signature | R | Same as in section 2.4. Calculation of the Signature |

Make sure url parameters are properly urlencoded in url and not encoded when calculating signature.

To capture user entered card data merchant needs to create a form with following inputs

<form name=”dummyInputs” action=”https://neversumbit.this/neversumbit.this”>

Card number: <input type=”text” id =”card.pan” size=”20” maxlength=”40”/><br/>

Expiration <select id=”card.expiryYear”> with year options from now to now +20 (2018..2038)</select>

<select id=”card.expiryMonth”> with month options 01..12</select> <br/>

Name on card: <input type=”text” id =”card.holderName” size=”20” maxlength=”40”/><br/>

CVV2 <input type=”text” id =”card.cvv2” size=”5” maxlength=”5”/>

</form>

Important: inputs and selects must be without name attribute and that form must never submitted to server.

To capture encrypted card data merchant shall call script function

var results=getEncryptedCardData(cvvRequired, nameRequired)if parameter cvvRequired or nameRequired is false then input of this value is not required)

in return of function call merchant receives an object with properties.

If exists element ‘cardEncData’ in result object (results[‘cardEncData’] then inputs were considered valid by format and encryption was successful and merchant shall take this value and proceed to XML api payment in server side. Optionally results[‘cardType’] contains information about card type detected.

If merchant system captures inputs independently then it can use equivalent method encryptCardData with parameters passed independently of input means

var results=encryptCardData(cardPan, cardExpiryYear, cardExpiryMonth, cardCvv2, cardHolderName, cvvRequired, nameRequired)Or if its used with combination of existing token from tokenization and only CVV need to be captured can be used function

var results=encryptCVVOnly(cardCvv2);In case of input or other errors merchant can extract following error from result using keys/properties and display them user if needed

errorPan (value "Card number must be number with length 12..19")

errorExpiryYear

errorExpiryMonth

errorCvv2

errorHolderName

errorCardEncData in case of encryption error.

errorDebug error details in case of encryption error.

3.4.2 Browser client side card data encryption for API messages with included PSP iframe

In case security is first priority then even more recommended approach is that merchant site includes iframe with card input fields from service provider. Such iframe content is on browser level protected from data mining by javascripts on merchant site by purpose or by site compromise. In that case merchant may be exmpt of full PCI-DSS requirements (verify with Your PSP or auditor) and integration is performed as follows:

On merchant site payment page where is desirable place for card data entry merchant include client script with iframe

<script type="text/javascript" src="https://pay.test.maksupay.com/vpos/csescript.js"> </script>

<iframe id="vpos-cseiframe" style="display: inline-block;" width="480" height="110"

src="https://pay.test.maksupay.com/vpos/cseiframe.html?version=5&mid=1234567&date=201804271539&signature=xxxxx”> </iframe>

Url parameters are exactly the same as when including javascript in section above.

Note: iframe only contains input fields and selects, no buttons. Button must be on merchant site and then call function

getEncryptedCardDataFromIframe(cvvRequired, nameRequired,callbackFunction);This callback function is called with parameter results in section 5.0 above

For example

function myCallBackFunction(results)

{

if (results[‘cardEncData’]!=null)

{

document.getElementById(“cardEncData”).value=results[‘cardEncData’];

document.getElementById(“payform”).submit();

}

else

{ alert(“Card data not valid”); }

}

3.5. Payments with GooglePay™

Merchants who want to include GooglePay buttons on their self hosted payment pages must ensure they are familiar with GooglePay and adhere Google Pay Web brand guidelines, those guides are available at following Google pages: